Case studies

Publication Date

27 April 2022

Published

27 Apr 2022

Clean Ganga Program

Context

- India’s holy river Ganga is a water source for more than 400 million people, over 40% of India’s population, and supports the agriculture, fisheries, transportation, tourism, and manufacturing industries along the river.

- Due to population growth and urbanisation, there has been a large stress on water resources leading to seasonal water shortages and water pollution.

- An estimated 8,000 million litres of untreated waste and sewage from factories and cities flow into the river each day.

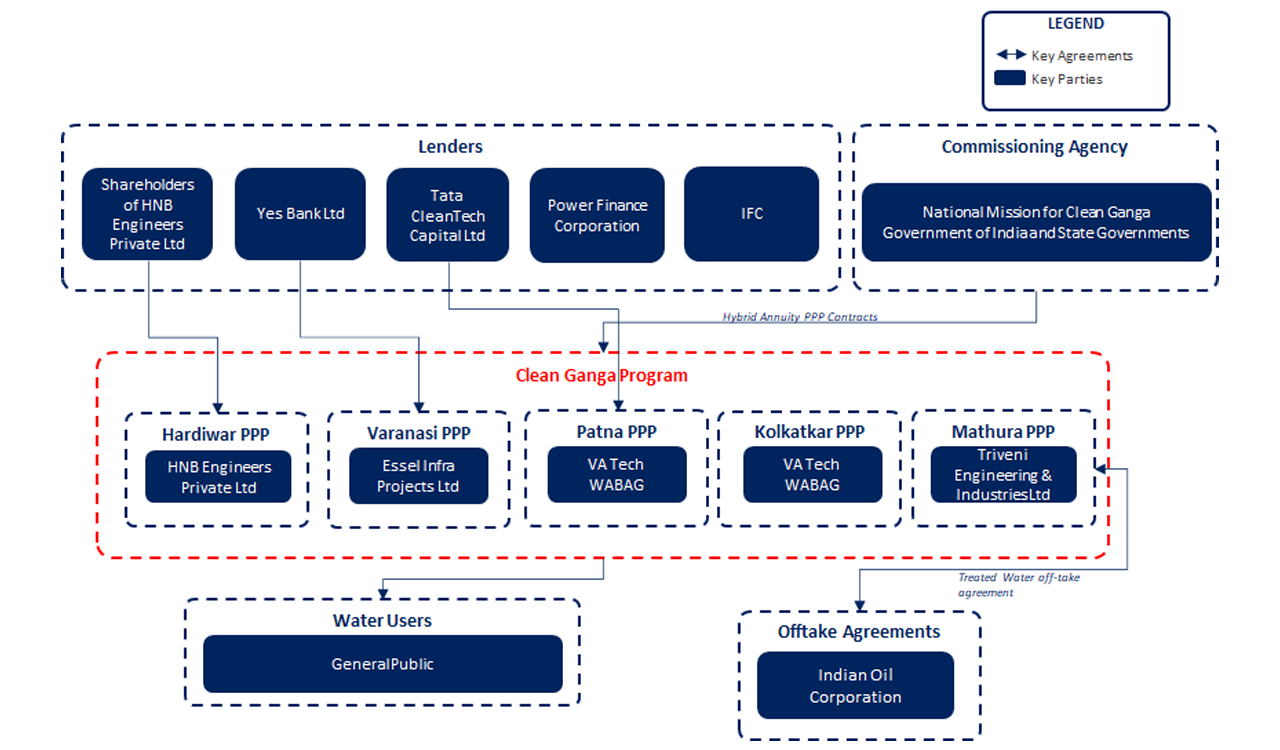

Stakeholders involved

- Government of India and provincial governments

- National Mission for Clean Ganga (NMCG)

- Local municipalities including UP Jal Nigam and the Kolkata Municipal Development Authority

- Concessionaire winning the projects under the program

- World Bank Group including the IFC as lead transaction advisory; IFC also provided debt funding for a project under the program

- Lenders such as Tata Cleantech, Yes Bank, and Power Finance Corporation

- Off-takers like Indian Oil for projects where clean water is sold

Problem

- An estimated 8,000 million litres of untreated waste and sewage from factories and cities flow into the river each day.

- More than half of the wastewater treatment plants in the basin were either not complying with discharge norms, or not working at all. In some areas, cholera posed a serious health threat to local populations.

- Governments and urban local bodies have invested billions of dollars since the 1970s into sewage management and wastewater treatment with little improvement in the water quality of the Ganga.

- There was little private sector interest in the development of wastewater plants due to high risks and lack of bankability.

Innovation

- As lead transaction advisory for the first three projects in Varanasi, Haridwar, and Mathura, IFC helped design the hybrid annuity model, where the government assumes all payment responsibilities under the contract, addressing a key bankability issue. It pays 40% of the project cost linked to construction milestones. The remaining 60% is paid over 15 years as annuities to the private concessionaire along with operation and maintenance expenses. These payments are linked to performance to ensure longevity of wastewater assets and enhance project viability for the private partner.

- An innovative offtake was structured for the new sewage treatment plant in Mathura, Uttar Pradesh, where Indian Oil will use treated wastewater to cool its refinery, which will save 20 million liters of fresh water every day

- Operators would be allowed to generate revenue in innovative, environmentally-friendly ways, such as selling treated wastewater or generating power through biogas.

Timeline

Results and impact

- Competitive bidding process: The market response to the tender was unprecedented, with the projects in Varanasi and Haridwar receiving eight and six bids, respectively.

- Public benefit: The program is expected to improve drinking and industrial water supply, which will reduce the stress on groundwater and make non-contaminated irrigation water available for the cultivation of agricultural crops. It will also contribute to increasing wastewater treatment capacity in the service areas, helping reduce the flow of untreated wastewater into the river, and helping address environmental issues.

- First of its kind: As the first successful hybrid annuity PPP applications in this sector, these projects represent a significant paradigm shift towards sustainable, PPP-based wastewater treatment business models in India. The long-term off-take agreement for treated wastewater in the Mathura project was the first of its kind.

- Replication potential: This transaction structure has huge replication potential in other states in India and has significantly increased investor confidence in the Clean Ganga program and in NMCG as a partner. Through this investment and the broader Namami Ganga Program, the WBG is supporting the Indian Government to demonstrate a replicable business model to acquire essential investments in the water sector. NMCG is developing hybrid annuity projects in 29 cities in 18 packages using the model documents developed by IFC.

Key lessons learnt

- Transferal of the counterparty credit risk from individual cities to a national-level entity attracts investors. The NMCG effectively de-risked the asset because individual cities and water corporations were not creditworthy.

- A continuous feedback loop for the key stakeholders is critical for success. NMCG carried out multiple consultations and roadshows with the investors, lenders, contractors, and experts to understand their views and suggestions on the structure and the bid process. This helped NMCG evolve the program into an impactful intervention by designing subsequent projects as per the ‘one-city-one-operator’ concept.

- Use of the program to influence broader sector reforms. The projects incorporate several sectoral innovations such as revenue generation from byproducts and use of renewable energy. In addition, NMCG is trying to create a market for recycled wastewater through the program.

- Assistance provided by IFC in technical, legal, analytical and marketing support was key. The IFC supported the comprehensive assessment of potential political or environmental risks associated with governance regimes and private partners.