Case studies

Publication Date

27 April 2022

Published

27 Apr 2022

Tibar Bay Port

Context

- In the early 2010s, Timor-Leste began its recovery toward social and economic stability after occupation and civil unrest had destroyed the country’s infrastructure.

- The country is the second most oil-dependent country in the world, with oil accounting for 80% of GDP.

Stakeholders involved

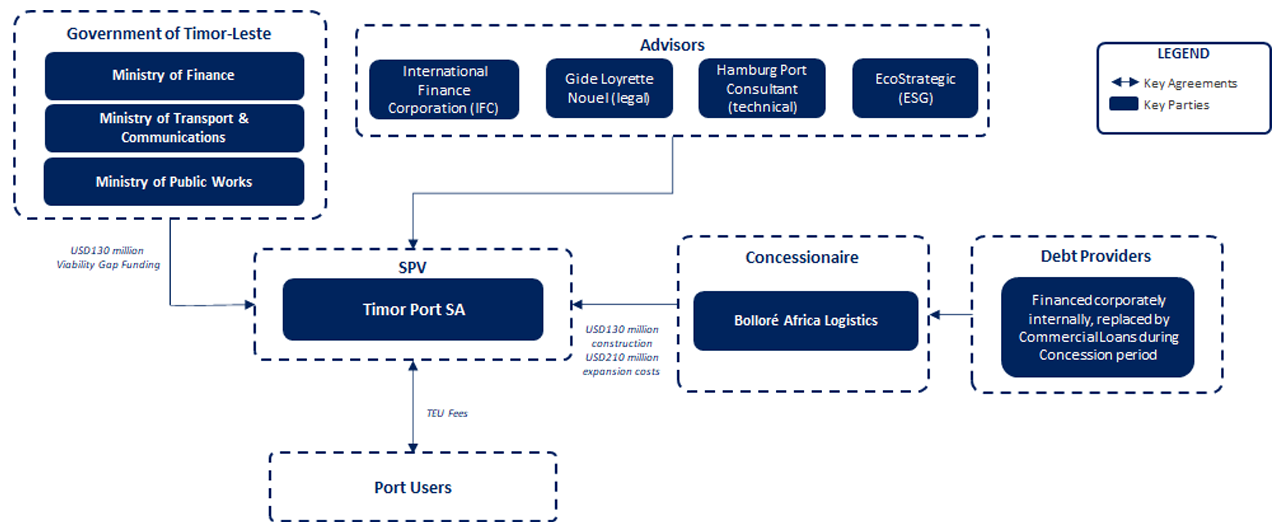

- Government of Timor-Leste

- Private partner, the Bolloré Group

- IFC as lead transaction advisor

- Technical assistance grants and support from DevCo, the Public-Private Infrastructure Advisory Facility (PPIAF), World Bank, Asian Development Bank (ADB), and Australia’s Department of Foreign Affairs and Trade (DFAT)

Problem

- With development of the oil and gas sector driving strong economic growth and imports, cargo volumes handled at Timor-Leste’s existing Dili port was expected to exceed capacity, causing congestion and high costs as a result of delays.

- Whilst the government sought to prioritise major infrastructure investments such as shipping ports and airports, it was difficult to attract international investors to finance and build much-needed infrastructure, due to the lack of a PPP or investment track record and Timor’s history of conflict and instability.

Innovation

- IFC worked with Timor-Leste’s new PPP Unit to deliver a transparent tender process that attracted globally reputable port operators. The key bid variable was the Viability Gap Financing subsidy required by each bidder after a very strict technical pre-qualification.

- As lead transaction advisor, IFC helped to build capacity in key institutions to develop, legislate, and implement PPPs. IFC developed contractual regimes around exclusivity, termination, and handover to balance the interests of the government and the market. IFC also delivered intensive environmental and social scoping in line with IFC Performance Standards.

- The transaction structure is based on a 30-year concession under which Bolloré is responsible for the design, build, finance, operation and maintainance (DBFOM) of the facility. Strong operational performance requirements were built into the contract, alongside rigorous environmental and social standards.

- Bolloré was responsible for all investment apart from the initial government subsidy and assumes the traffic risk. Charges for services are based on a tariff schedule defined in the Concession Agreement and the government receives a TEU royalty fee and other revenue.

Timeline

Results and impact

- The Tibar Bay Port is Timor-Leste’s first PPP, with private financing five times larger than any previous private investment outside the oil and gas sector, and will create 500 local jobs.

- It will attract private investment of USD360 million over the 30-year life of the Concession, with USD150 million in the construction phase.

- The port is vital for government efforts to establish new logistics and industrial zones that will help diversify Timor-Leste’s economy, create economic opportunities for its citizens, and open doors for future private investment in the nation’s infrastructure.

- The port will solve the bottleneck congestion expected at Dili Port by improving cargo handling times and reducing delays, ensuring that Timor-Leste has modern port infrastructure upon which its trading future can be built.

Key lessons learnt

- Implementation of the PPP gives a signal to other investors that Timor-Leste is an attractive place to do business.

- Strong government leadership and commitment enabled success through capacity building in partnership with the IFC and other partners to develop institutional mechanisms and a PPP unit within the Ministry of Finance, with a clear mandate to facilitate PPPs.

- Leveraging the broader World Bank Group’s work benefitted the project by delivering complementary investment policy and customs reforms.